Applied Finance Blogs

The Evolution of Fintech: What Every Aspiring Finance Professional Should Know

Posted by: RVS CAS | Applied Finance

Fintech, short for financial technology, has come a long way from its humble beginnings. It started with basic tools like credit cards in the 1950s and ATMs in the 1960s, revolutionizing how people accessed their finances. By the 1980s, digital stock trading was making waves, and the 1990s ushered in e-commerce, setting the stage for online payments. Today, fintech encompasses everything from mobile banking apps to blockchain-based solutions, transforming the financial landscape globally.

Read More

Building Financial Models: How to Build a Financial Model?

Posted by: S.Vinoth | Applied Finance

A financial model is used to calculate, forecast or estimate financial numbers. A financial model is simply a quantitative representation of financial information of a business, organization or a government. Models can therefore range from simple formulas to complex computer programs that may take hours to run. These are the mathematical models in which variables are linked together.

Read More

Demonetisation 2016: A Big Transformation in Banking Sector

Posted by: Jayashree T | Applied Finance

Banking sector in India played an important role in economic growth and development. There was a big transformation in this sector after Government of India demonetized Rs 500 and Rs1000 currency notes in November, 2016 with the motive of bringing down black money, corruption and promoting cashless economy. It is reported that Rs15.4 lakh Crore constituting 86.9 per cent of the value of total currency notes in circulation were demonetised. The customers deposited and/or exchanged their banned currency notes, which in turn increased the cash deposits in banks. Further, usage of formal banking system, cash less transactions and digitalisation increased.

Read More

How to become a Financial Analyst?

Posted by: Dr. S Vinoth | Applied Finance

A financial analyst advises their clients when to buy

and sell investments. Financial Analyst provides

guidance to small, medium and large businesses,

individuals to make investment decisions. They analyze

and understand the financial condition of the firm

through internal analysis and external information of

the company. Financial Statement Analysis, Equity

Valuation and Financial Modeling are the major areas

covered under this.

Financial Analysts evaluate investment opportunities and

help the investor to take decisions like where they can

invest? How much can they invest? And How to manage

risks and return. Financial Analysts evaluate

individuals’ investment pattern, possibility of

investment, Buy and Sell decisions and presents

insightful inputs to the investor.

Applied Finance – The Golden Ticket to a Career in Finance

Posted by: Dr. S Vinoth | Applied Finance

In India, the employability index showed a minor improvement from last year, rising to 38.12% from 37.22%. Specifically look about Finance roles in India increasing more in various sectors. Secondary Sector in India wants more efficient finance person to manage the money of their enterprise. Finance is an area consists of Economics, Management, Consulting, Advising, Mathematics etc. The need for a person with Finance skill is increasing tremendous in various Indian industries. But the same time, there will be scarcity in skilled finance professionals. The scarcity numbers also increasing year by year because of less practical knowledge among the professionals.

Read More

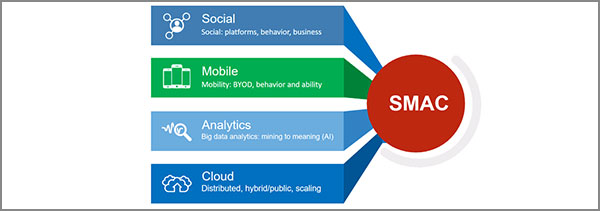

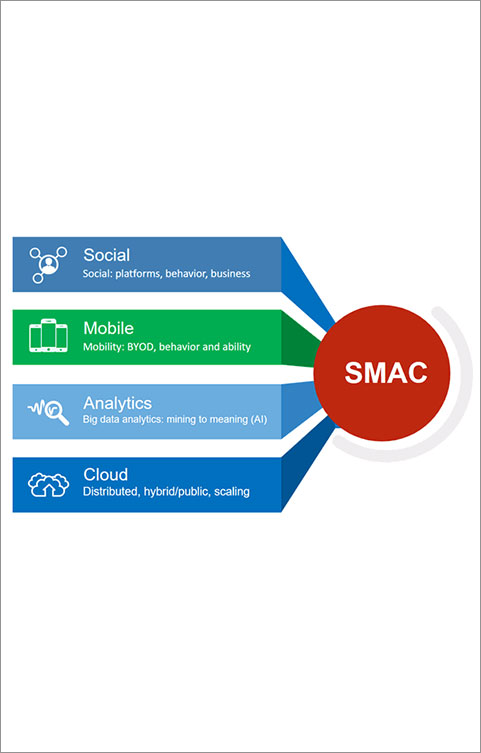

How does SMAC Technology shape your career in Finance?

Posted by: Jayashree T | Applied Finance

In the era of digitalization, India has the third largest number of technology driven start-ups in the world and it moves ahead in doing business with competitive advantage. In particular to banking and financial services sector, technology enables the whole act of money transaction better, stronger and faster. It aims to compete with traditional financial methods in the delivery of financial services. Use of smart phones for mobile banking, payments, e-wallet services, investment services are some of the examples of technology transformation in the form of accessibility, adaptability and flexibility. With this move, rise of Fintech startups grow rapidly in the financial services sector, disrupting the traditional operations but reconstituting the competitive landscape in the financial industry. Ahead of this change, adoption of SMAC (Social, Mobile, Analytical and Cloud computing) technology collaboratively boosts the financial markets, banking and institutions.

Read More

MS Excel Skill - Exceeds the Value of MBA!!!

Posted by: Dr. S Vinoth | Applied Finance

Most companies are looking for people with expertise in MS Excel. MS Excel is the best tool in finance but also used in marketing, sales, human resources, production, operations etc. It won’t be exaggeration to say that in reality MS Excel is a life-partner for a management professional. There are students who complete their MBA without proper understanding of MS Excel, but they have to learn it sooner than later since it is integral part of a managers’ daily life.

Read More

The art of financial planning for a better future life - Today’s Right investment →Tomorrow’s Better Prosperity

Posted by: Dr. N. Kanakaraj | Applied Finance

In the present scenario financial planning is a disciplined process and customized approach, which enables wealth for clients by way perfect advising. Financial Planning stay focused with client’s wealth maximization without sacrificing liquidity. Further these professionals use their expertise and prudential skills for enhancing the client’s profitability through attractive higher return. Effective financial planning is required by the clients due you to the paucity of most valuable financial resources available for investment. In simple terms, financial planning takes the dreams and life goals of individuals and these goals are divided into measurable financial goals and it can be achieved with systematic way of taking rational financial decisions.

Read More