Building Financial Models: How to Build a Financial Model?

Posted by: S.Vinoth | Applied Finance

Introduction

A financial model is used to calculate, forecast or estimate financial numbers. A financial model is simply a quantitative representation of financial information of a business, organization or a government. Models can therefore range from simple formulas to complex computer programs that may take hours to run. These are the mathematical models in which variables are linked together.

In general, financial modeling is about creating a complete structure or program, which helps you in coming to a decision regarding investment, forecasting, and valuation of a project or a company. Now this could be on a simple piece of paper or in Microsoft Excel.

Many people use Microsoft excel only for creating spreadsheets and charts. These are used for management information or accounting purpose. They only use basic features of excel, where it can be used to create complex financial models, which can be used for various analysis.

The motive behind building financial models is to help is:

- To forecast a company’s future earnings, performance, and financial health.

- To help in valuation of a security, forecasting future raw materials requirements for a company or determining the benefits of a hostile takeover or merger.

- To develop several scenarios as part of the budgeting process

- To determine a range of outcomes on cash flows return related to a prospective fixed asset purchase.

- To determine the greatest negative effect on a firm, as part of a formal risk analysis.

The financial model usually projects the balance sheet, income statement and cash flow statements monthly for a period of three to five years. A good financial model provides all the key assumptions and allows the user to run sensitivity analysis by changing one or several assumptions at one time and see the overall results on the projected numbers.

A Financial model is nothing but a MS Excel representation of a company’s financials. The financial model is one large MS Excel file, that has many tabs including – Income Statement, Balance Sheet, Cash Flow Statement, Depreciation Schedule, Debt Paydown, Valuation, Sensitivity Analysis, Ratio Analysis and Assumptions. Each of these tabs will have two components – historical and projected data.

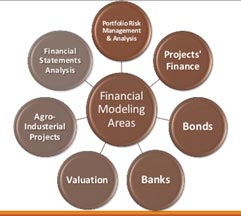

Where Financial Modeling is highly applied?

Financial Modeling is highly applied in Corporate Finance, Investment banking, Equity Research and Accounting profession. A financial model can be used in:

- Option Pricing

- Business Valuation

- Project Finance

- Merger & Acquisition

- Risk Modeling

- LBO Analysis

- Financial Statement Analysis

- Management Decision Making

- Capital Budgeting

- Forecasting

- Equity Research & Valuation

What is the characteristics of a sound Financial Model?

A good financial model is:

a. Easy to understand – uses a transparent design

b. Reliable – uses control checks so that an error is automatically flashed

c. Easy to use – so that one can be more productive in using the model for analysis rather than struggling just to produce simple results from a badly designed model

d. Focused on the key issues – so that one does not waste too much time in development of immaterial items.

How do you develop a Financial Model?

1. Clint Objective

There are no models everything – and this is the one of the first statement modular should have in mind. It is important to define, model objectives first before embarking upon creating a financial model.2. User Needs

The user needs are different from one with another. For instance, a Clint may want to build a model for projecting the prices of a commodity which is used as a raw material for manufacturing the end product by a company, would need a good model to understand of the demand-supply dynamics for that commodity and in-depth analysis of the emerging trends

3. Plan & Structure

Similar to any software, every financial model has three important elements:

a. Input

b. Processing/ Logic

c. Output

It’s important to work backwards from the final delivery deadline to ensure smooth development process. The Structure of the model should be such that it clearly segregates the Inputs, Processing (calculations) and the Output.

4. Specifications

Developer should be careful on specifications of a model. A Financial Model is a transactional-based application that allows multiple users to edit and view different financial aspects of a business. It is used to analyze financial data and to support business decision making. The developer should go in-depth in to the model and help the user to view any desired summary reports, graphs, or detailed transactions; a way to update and correct individual transactions; and a way to dynamically create new reports of interests.

5. Build & Code

Using modular spreadsheet blocks will make changing each sheet easier without affecting others. Proper protection should be given to the sheets and workbooks from unauthorized usage. Labeling sheets, columns and rows with their applicable headings so that files will become easy to follow. Assumptions documentation helps with validation & avoids misinterpretation. Listing assumptions will be helpful for easier and quicker understanding. Adding source data as well as calculations will provide a good map. Linking wherever required will be a good practice such that when the inputs change, the outputs will be changed automatically. It will save lots of hassles at final stage or at working stage.

6. Testing and Auditing

Testing is an extremely critical element of the financial model as even a small error can create confusion in the final stages and may lead to incorrect output, which if gone un-noticed may lead to incorrect decision making. Once the framework of the model and base scenario is ready, you need to test whether the model holds under various scenarios. When a model has many inputs, they may start affecting the overall flow. It is therefore important to see if changes to one input are not affecting any other functionality anywhere. A model has to be stress tested to see if all linkages are working correctly, or not.

7. User Review

Placing dependence on a spreadsheet model when making key decisions is a risky business. Many spreadsheet models are reused from earlier projects or from templates that have been updated by a number of different staff. This significantly increases risk of error. Model review activity by a user will help to reduce this risk.

The activities are tailored to your needs and may include:

- Sense checking the model from a commercial perspective

- Review of logical integrity and mathematical accuracy

- Review of formulae consistency

- Review of model outputs and logic against bid documents

- Review of the model inputs and calculations against formal documentation

- Review of controls in place to minimize error and advise practical steps to implement

Conclusion

A financial model is very similar to a software program with inputs (assumptions), logic (calculations) and output (financial statements, key parameters). The stages of model development planning, designing, developing, documenting and testing provide the building blocks for effective financial modelling. Well planned, designed and maintained business critical models will cause fewer issues as models can deteriorate over time. Developing Financial Models is important skill for a professionals who wants to explore the world of finance and wants to get into money related decision making matters. People who are pursuing CFA, MBA, FRM or other financial certifications as this will work as an added advantage for them. Financial Modeling itself is a skill that helps you to build a finance career but to be good at financial modeling there are a certain things that one should possess: Excellent Excel Skills, Knowledge about Accounting, Finance & Valuation, Problem solving ability and, Time Management.

Reference: Read MoreRead More

Read More

Read Mores