The art of financial planning for a better future life - Today’s Right investment →Tomorrow’s Better Prosperity

Posted by: Dilip D | Applied Finance

Preamble of Financial Planning

In the present scenario financial planning is a disciplined process and customized approach, which enables wealth for clients by way perfect advising. Financial Planning stay focused with client’s wealth maximization without sacrificing liquidity. Further these professionals use their expertise and prudential skills for enhancing the client’s profitability through attractive higher return. Effective financial planning is required by the clients due you to the paucity of most valuable financial resources available for investment. In simple terms, financial planning takes the dreams and life goals of individuals and these goals are divided into measurable financial goals and it can be achieved with systematic way of taking rational financial decisions.

In this context, the alternative avenues for investment are presented in a big picture approach.

A dream of the clients is fulfilled by the financial planner by way of undergoing predefined set of processes with the clients, gives holistic advice, get to know about a wide range of physical assets, financial assets and digital assets and its attributes, and match the client financial goals by taking big picture approach.

Mantra for financial planning is “You can sleep but your hard earned money shouldn’t allow to sleep”.

Elements of Financial Planning Process

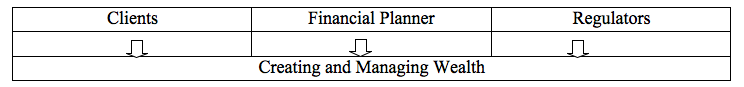

The ultimate aim of financial planning process is optimum use of scare resources of the clients for wealth creation and wealth management by financial planners through a dynamic process under the supervision of regulators.

Regulator of Financial Planners in India

Notably, Financial Planners & Investment Advisers are regulated by Securities Exchange in India under SEBI (Investment Advisers) Regulations, 2013 which included “Financial Planning” in the definition of “investment adviser”

“Investment Adviser” means any person, who for consideration, is engaged in the business of providing investment advice to clients or other persons or group of persons and includes any person who holds out himself as an investment adviser, by whatever name called.

Here “whatever name called” includes “Wealth Manager, Life Planner, Investment Specialist, Retirement Planner, Wealth Coach, Financial Planner or WHATEVER creative name that you came across for financial planning”.

“Saving is a great habit but without investing and tracking, it just sleeps”

- Manoj Arora, From the Rat Race to Financial Freedom

How it Works: Financial Planning Process

Financial planning aims at ensuring that clients have adequate income or resources to meet current and future expenses and any kind of financial needs. In the technology driven market the financial planner tend to look big picture when advising clients on wealth creation and management. Hence, to achieve the clients’ dreams and life goals the following process need to be put in place.

The first stage of planning process begins when the client engages a financial planner and describes the scope of work to be done and the terms on which it would be done.

The second stage focuses on The future needs of a client, which require clear definition in terms of how much money will be needed and when.

The third stage in the process provides risk profile of the clients and the current financial position of a client needs to be understood to make an assessment of income, expenses, assets and liabilities. The ability to save for a goal and choose appropriate investment vehicles depends on the current financial status.

1. Client Engagement

2. Identification of goals

3. Risk Profiling

4. Investment Plan

5. Discussion on Investment

6. Monitor and Review

The fourth stage concentrates on present financial planning recommendations which makes the planner makes an assessment of what is already there, and what is needed in the future and recommends a plan of action. This may include projecting income and expenses, reallocating assets, managing liabilities and following a saving and investment plan for the future.

The fifth stage in the process is investment. Once the investments are done, continuous discussions on those needs to happen and the final stage is to know the financial situation of a client can change over time and the performance of the chosen investments may require review. A planner monitors the plan to ensure it remains aligned to the goals and is working as planned and makes revisions as may be required.

Financial planning is an Inevitable Tool for Every Individual’s Long Term Sustainability

Financial planning is essential for the clients who wants to create a road map for his/her future goals and dreams, who believes in a disciplined approach to savings and investments, who wants to achieve his/her goals in life without leaving them to chance, who is sitting on too much on a particular asset, who understands how a professional can be of help in personal finance, and finally clients who is looking for help in optimizing returns without getting exposed to unwanted and undesired risks.

The goal is n’t more money. The goal is living life on your terms

- Will Rogers

Knowledge required for Financial Planner

Financial planner requires time and attention to identify income and expense and duration of the same, estimates of future goals, management of assets and liabilities, and review of the finances of the clients which in turn requires the mastery in the field of personal finance.

If the financial planner don’t know better, they don’t do better hence in depth knowledge in Wealth Preservation and Creation, Investment Planning, Asset Allocation Planning, debt counseling, cash flow planning, budgeting, Children’s Education Planning, Children’s Marriage Planning, Vacation Planning, Estate planning, Tax Planning, Insurance & Risk Management Planning, Retirement Planning, other Specific goal oriented planning are highly essential.

Key Skills required for Financial Planner

To equip himself/herself as a financial planner he/she should obtain the mastery in personal finance through acquiring Technical, Communication and interpersonal skills.

These skills further broken-down into Analytical Skills for Problem Solving, Math skills which is used to calculate and analyze complex financial data, Financial planning software skills, Accounting software skills, Spreadsheets skills for easy and quick calculation as well as modeling, interpersonal skills, Selling Skills, Communication Skills, Skills required to synthesize, Creative Skills, Speaking skills which are required, because financial planner will likely be using some combination of the these for effective wealth creation.

Career Path for Financial Planner

The U.S. Bureau of Labor Statistics (BLS, www.bls.gov) predicts job opportunities for personal financial advisors to increase 30% from 2014-2024, much faster than the average for all other careers.In the entry level financial planning positions are trainees and executives with wealth managers, banks & product distributors. Once you are confident in the key abilities of technical competency, ability to give the right advice, and empathy skills to form and deepen the client relationship then you will be moved to middle level financial planning positions which are Sales Mangers, Relationship Mangers, and Wealth Managers. Further in this career financial planner reach to the senior level where one should expand his/her expertise across more and more of the domains – generally with heading the functional areas like retirement specialists, tax specialists and business/regional heads.

The average salary for a Financial Planner is Rs 391,802 per year. Experience strongly influences income for this job. Most people with this job move on to other positions after 20 years in this field. Additionally, individuals with qualifications such as MBA, CA, CFA etc. blended with CFPCM Certification may add 20-25 % to their expected emoluments1

“To accomplish great things, we must not only act, but also dream; not only plan, but also believe”. - Anatole FranceConclusion:

In nutshell, if anyone need to play a financial planner role in the current financial world he/she should know the characteristics of physical assets, financial assets and digital assets and their risk-return tradeoff which will expand the pool of knowledge in the area of investment instruments. Further this big picture approach helps in understanding how to meet the different financial goals for different clients.

In short, if you have goals in life, you need a financial plan for better future!!!

References: Read More