How does SMAC Technology shape your career in Finance?

Posted by: Jayashree T | Applied Finance

In the era of digitalization, India has the third largest number of technology driven start-ups in the world and it moves ahead in doing business with competitive advantage. In particular to banking and financial services sector, technology enables the whole act of money transaction better, stronger and faster. It aims to compete with traditional financial methods in the delivery of financial services. Use of smart phones for mobile banking, payments, e-wallet services, investment services are some of the examples of technology transformation in the form of accessibility, adaptability and flexibility.

With this move, rise of Fintech startups grow rapidly in the financial services sector, disrupting the traditional operations but reconstituting the competitive landscape in the financial industry. Ahead of this change, adoption of SMAC (Social, Mobile, Analytical and Cloud computing) technology collaboratively boosts the financial markets, banking and institutions.

Learn Future Financial Technology at RVSIMSR

SOCIAL

In spite of the untapped potential, India is the second largest in online market and the usage of social media increased rapidly in the present scenario. Primary communication media of one third population in the world has transformed from Radio, Messenger, TV to Internet, FB, WhatsApp and Twitter. It is reported that in 2017, India had 451.5 million Internet users and it is projected to have 635.8 million internet users in 2020. Social media helps banks and financial institutions identify the demographics, likes and preferences of their customers, analyze them and target their products and offer accordingly. The customers are encouraged to do banking services through socio channels. Exclusively FinTech startups like PayTM, FinServ, etc., are using social media to transform the traditional business models. Accenture and Partnership Fund has global investment in FinTech ventures with turnover of $1 billion in 2008 increased to $3 billion in 2013.

MOBILE

Mobile devices have revolutionized the people’s accessibility in today’s work place. With the introduction of smart phones and tablets, digital content has come to the fingertip of consumers. Banking, Insurance and investment companies provide wide range of digital devices like POS machine and applications through mobile like Digital Banking to increase the digital usage of consumers. Mobile ensures instant access to information and services, which enables banks to do business anywhere and everywhere. Mobile banking help banks and financial institutions serve new market segments. In 2015, ICICI, one of the leading bank, introduced a mobile app called pocket that can also be used by non-account holders to do all type of transactions such as utility bills payment, net transfer with other banks, etc. This service may help the bank to target huge number of customers. Exponentially increasing adoption of mobiles allows for innovative digital banking to transform the banking and financial sector.

ANALYTICAL

Big data analytics creates huge opportunities in the financial sector, as incredible amount of data flowing through various social networks provide valuable insights for companies to gain competitive advantage. Today’s financial services companies use Analytical tools as an enabling platform for analyzing voluminous customers’ data to identify fraud and to meet regulatory and security requirements. It is possible to generate billions of gigabytes of data at a low cost. It’s easier to retrieve and process information instantly and insights gained can be made as a competitive tool by the financial service companies. Various advanced tools such as robotics and cognitive automation aid to handle routine back office tasks and rule based transactions, providing employees to focus more on high priority objectives of the organization in delivering customer value.

CLOUD

Cloud in general refers to the ability of accessing services through an internet provider from anywhere using the web. Financial service industry effectively utilize Cloud computing technology for storage collaboration, internal and external sharing of data, stronger security, to lower maintenance cost and to increase productivity potential of the employees. It provides the technical infrastructure needed for any voluminous data analysis exercises for digital transformational needs. Most cloud service operators provide safe and secure email communication by enabling built-in protection against viruses, malware and multi-layer spam. Omni channel banking or branchless banking is fast becoming the future of banking as cloud-based technologies are adopted and utilized by the customers.

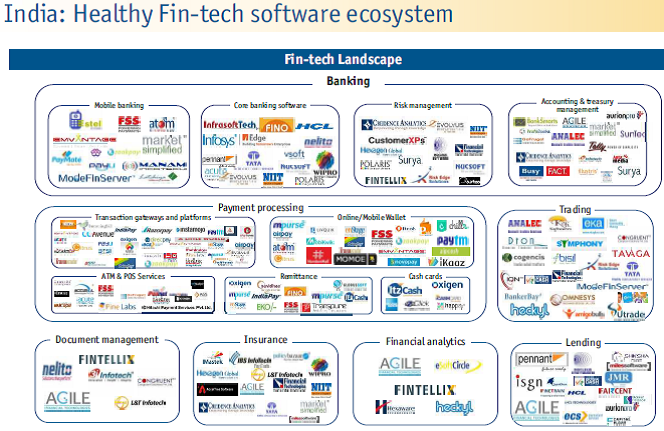

Rise of FinTech Companies in India

FinTech start-up could be a new application or process or products or business models in the financial services industry. Most of the time, it is composed of one or more complementary financial services provided as end to end process via internet. FinTech startups emphasize on superior access, efficiency and convenience, which drives towards a more decentralized financial system. FinTech unleashes a new era of competition, innovation and job opportunities for young potential’s. It also aims to provide the following:

- Innovative finance solutions help to assist small businesses by providing them with better cash flow, improved working capital management and more stable & secure funding.

- FinTech allows people to conduct transactions through their mobile phones or tablets in improving efficiency and the customer experience.

- More digitized transactions support greater audit capability, transparency in payment systems and security in transactions by reducing risks.

- The transparent and real‑time operation of FinTech innovations, such as block chain and digital currencies, are generating new value streams — not just in financial services but across the economy.

- FinTech can also help drive improvements in traditional financial services and promote disruption through innovative new products and services, which can offer benefits to consumers and other sectors of the economy.

Top Fintech companies in India are Paytm, Freecharge, Mobikwik, BankBazaar.com, Lendingkarg, Policybazaar, Vistaar finance, Capital float, IMFR holdings, Electronic payment services, Mswipe and Citrus payetc. These Fintech startup companies disrupt the entire value chain of banking and financial services segment through their innovatively developed technological products and services in the area of trading, personal finance, payments and equity funding. Moving from traditional method to digital method of doing business provides benefits to both customers and the firm. Indian banking and financial service could potentially disrupted due to advancement in fintech space.